The race for financial institutions to go digital, digitise their legacy systems or be “digital first” shows no sign of letting up. Customers expect a seamless journey and internal stakeholders will only invest in technology that is robust, cost-effective, secure and extensible into the future.

What does extensible mean? In the world of programming, it refers to a language, a system that can be changed by being extended or adding features. In other words, you don’t want to invest in technology that is static or fixed, because it will become obsolete. Can adopting APIs before you transform your entire technology infrastructure to a digital operation give you a competitive advantage?

Consistency of Customer Journeys

You want a system that can evolve with the customer, irrespective of their level of service or their preferred asset class. For example, if you built a self-service portal for customers invested in funds it might be difficult, if not impossible, to modify that application to handle customers who want to move to an advisor relationship or customers who want to manage their pension scheme along with their other investments. You might have to build another application and then integrate two applications to present a unified experience to the customer.

Using an API that is unconstrained by the type of user interface or the nature of the asset class will help unlock the value of your customer data. With OutRank, the technology can be applied to any asset class. Start with one, such as equities, then include fixed income and pension assets. Our financial simulation engine is a back-end solution driving financial analytics within a range of financial planning use cases. In particular, OutRank delivers intelligent forecasts within the context of investments, pension, mortgage, insurance and holistic financial planning applications, allowing you to create visual and pedagogical experiences for the customers. In addition, it provides profiling analytics, tools for identifying potential issues within the customers’ allocations and addressing these issues as they progress towards their goals. Essentially, all you need to foster engagement in your digital & hybrid channels and dramatically cut the costs for providing investments and savings guidance (including pensions). Best of all, the customer can experience the enlargement of the capability, across new asset classes, as a natural consequence of the user journey.

Data Integration and Learning

Equally important as the customer experience is the ability to use data across your organization. Using the lessons learned from customer outcomes and feeding that knowledge back into your organization for new insights into what other customers need is vital. Instead of engaging in expensive market research and surveys, you can look at trends expressed by your customers (anonymized, of course) to inform how you should tailor your offerings.

For example, you may learn from customer activity in your portal, app and through conversations with advisors that groups of customers are very concerned about inflation, from news reports about the rising cost of living. You can, for example, use OutRank to visualize and demystify what a rise in interest rates or energy prices might mean for a customer’s portfolio over several decades. You could then launch a communications campaign to educate customers about inflation and what it means for their retirement planning.

Agile API Adoption as a Productivity Tool

In large organizations, stakeholder management takes a lot of time and energy. To get budgets approved for enterprise-wide technology projects, it can take months of presentations, lobbying, meetings, horse-trading and cajoling to get the resources you need. However, if you articulate the desired outcomes of an API integration and get stakeholders to fully endorse the small budget required, the benefits will be apparent. Assuming the integration of the API solution is successful, the demonstration effect will cascade throughout the company.

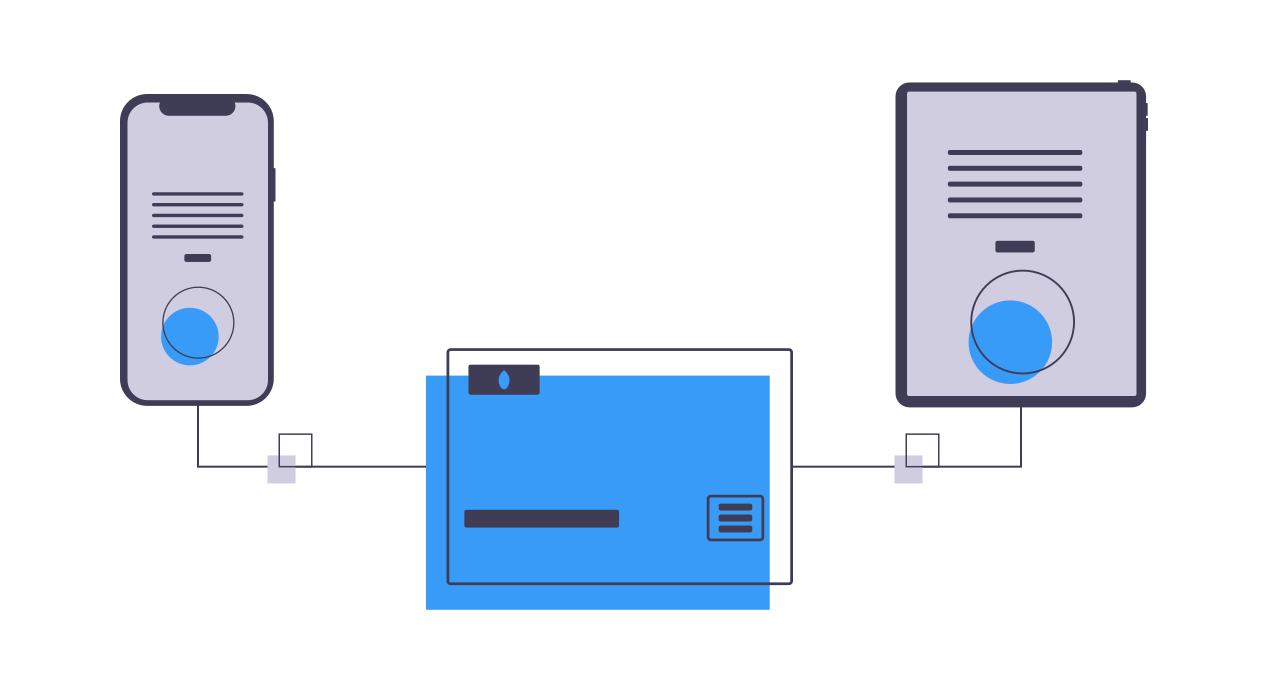

With OutRank, you can prove to the most skeptical stakeholders that the technology meets their financial, operational, compliance, risk management and audit needs. The cost is reasonable, and the cloud-based technology is compatible with all legacy systems. Data that is captured, stored and analyzed in silos can be processed more efficiently through integration of API solutions. Cost savings can be monitored by capturing the usage of data and the elimination of duplication of efforts across business units – the approval needs to be achieved only once since the solution is flexible enough to support various use cases. The inefficiency of silos can be mitigated with the intelligent use of data.

Compliance colleagues will be reassured that Kidbrooke designed the OutRank API to be compliant with GDPR regulations as a minimum and has adapted it to meet specific requirements in individual countries such as Denmark.

Some companies, having had bad experiences with small vendors, have adopted a vendor risk management maturity model (VRMMM), a tool for measuring third party risks. Six levels of risk are defined, ranging from startups with little awareness of risk management to more mature vendors that have a clear framework for risk management with continuous improvement. With Kidbrooke, you can rest assured that we have been successfully working with some of the largest insurance/financial organisations in Sweden. From a governance perspective, our data can be used to construct audit trails if required by internal audit colleagues or by regulators. Our workflows are safe, secure and transparent.

Stop Re-inventing the Wheel

Imagine that you installed OutRank for one subset of customers, ten years ahead of retirement age. All stakeholders were happy with the results. Then you decided to expand the use of OutRank to younger customers, who had 30 years of earning, saving and investing to manage. Would you go back to the drawing board, doing an RFP, asking all the stakeholders to evaluate competing suppliers? No, you would use what you have. OutRank supports the full balance sheet approach which allows it to analyse virtually any use case that requires cash flow modelling. You can then work with us at Kidbrooke to co-create the next iteration of the API, to apply it to other challenges – customer types, asset classes, interfaces – within your business. The use of an API enables a “read across” of data across lines of business, and facilitates transparency into golden sources of data, quality of data and processes to improve operational productivity.

Action

Bringing simplicity to complexity is how you can inspire colleagues to act. Starting small, with an API solution to improve the customer journey for one type of customer. Beginning with a small sample size makes the process less daunting than overhauling your entire tech stack.

Does it have to be all or nothing: a big digital transformation or no change to existing functionality? Or can you take a step-by-step, incremental approach?

At Kidbrooke, we believe in thinking big, but acting small and fast. The goal of API technology adoption is to provide a seamless customer experience and an observable step forward to digital transformation.

Integrating an extensible API into your existing technology stack can dramatically improve your offering. With OutRank, we keep it simple, transparent and dynamic, helping financial providers create an integrated, holistic customer experience for a reasonable cost across their lines of business.

To learn more about how Kidbrooke can help you extend and differentiate your digital financial planning journeys, please get in touch.

Sources:

Leave a Reply